This was a business proposition for Maybank on adapting banking experiences for higher adoption among Millennials in the local context. This case study showcases my ability to translate challenges and research insights to product design.

Introduction

Millennials occupy about 30% of Malaysia’s population, and varies between 25-40% in Asia. By 2025, 75% of the global workforce will be millennials, and as the second largest population on earth they will be one of the key market drivers, banking industry included.

Millennials grow up as digital natives, with their lifestyles often intertwined with the digital world. They are tech-savvy, mobile, and expect high level of convenience and connectedness from services they interact with.

As more products and services go digital to accommodate demands, millennials are also used to interact with them without sense of connection and loyalty, treating them as commodities with no human touch, and hence will go for the lowest cost with the highest value.

The opportunity

This in turn presents the opportunity to distinguish oneself from the digital crowd – millennials engage better with brands when they can connect more authentically and emotionally with the communities and individuals they serve, that is when they present themselves with a sense of purpose and identity.

This brings me to my three key opportunity areas I’ve identified to focus on when designing the banking experience for millennials:

- Appetite for frictionless, omni-channel offerings beyond the current digital banking experience.

- Need for empathetic offerings and close-to-heart assistance.

- Desire to associate oneself to a sense of purpose and identity.

1. Satisfying the ever-growing expectation.

Millennials’ expectations are ever-evolving alongside technology advancements. Being in a world where resolutions are given almost at an instant, they can no longer be content with simple financial products and services, and are always looking for new and exciting experiences with high level of convenience and frictionless interactions.

According to BCG’s REBEX 2020 Survey, 100% millennials expect their internet or mobile banking service to be good and easy to use. 98% expect guidance during onboarding or setting up of accounts, while 67% expect their banking concerns to be addressed properly.

*Survey is based on 17,600 millennial respondents across 30 countries.

With digital life being mainstream, the expectations of instant gratification are inherent among millennials. They are used to getting answers instantly from Google, car rides and food deliveries with just a few taps from Grab, FoodPanda, and Gojek, new movies anytime, anywhere from Netflix.

This presents a great challenge for some industries that have conservative standards of procedures for their products and services. But if handled properly, this can be a great opportunity if we can ride the waves of change. Digitising basic banking services will meet their expectations, but won’t be able to keep them invested for long, not until we can offer them frictionless and holistic experiences that not only goes beyond basic banking but shape their banking habits.

And in another survey by The Economist Intelligence Unit on millennials, found that they are more digitally native when it comes to payments compared to Western countries:

80% millennials expect to be able to pay digitally at online and physical stores, and 74% think it’s important to have e-payment options at online stores.

*Survey is based on 826 millennial respondents across 12 countries, 10 from East and Southeast Asia.

The ideas

While it’s good to offer quick-win banking features favorable to millennials such as bill-splitting, expense tracking and easy transfers, I try to think of ways we can truly integrate banking offerings into millennials’ lifestyle. Firstly, we can offer seamless payment experience regardless of device and locations. Secondly, we can position ourselves as care-taker of their financial wellness while cross-selling existing products as solutions.

An integrated, one-for-all payment: Maybank OnePay

We can’t deny that the market is slowly saturated with many e-wallet or digital payment options, this is also why 67% of millennials say they would like to have one way to pay as compared to 59% of non-millennials.

While most payment experiences are disjointed across user’s different devices and merchants, I’m proposing a frictionless, cross-device payment integration – pay anything from one device.

a cross-device payment integration to pay for your purchases anywhere, physical or digital, all from your mobile app.

Got sucked into an ad while working on your work laptop and want to get that cool waffle machine? Scrolling through Apple TV on your bed and dying to rent and rewatch “The Godfather”? No saved payment details on these devices? No problem.

Scan the OnePay Code on any screen or cashier and pay through your Maybank app, no need to enter your credit card numbers on so many devices over and over, and over again.

Automate frictionless saving & investing: Maybank Save & Grow

One of the shortcomings of traditional banks is the entry barrier to their investment products. Millennials won’t have the time and patience to go through steep learning curves, tedious steps and approvals, which is why many other investment alternatives are winning the millennials with their simplified, hassle-free experiences.

Here I’m proposing to power up the Tabung feature to have automated deductions from your monthly salary payouts. On top of that, the app will automate investment deposits with the Tabung savings by purchasing from our investment portfolio, given some adjustments on barrier of entry and streamlining of processes.

Sign-up for automated savings and we’ll automatically put 10% of your monthly salary aside to your tabung! That’s not all, let us help you grow your money faster towards your goal too.

You can now put your mind to ease while we help you grow them with our automated investment feature – We invest the amount of your tabung into various products we have in our portfolios.

No minimum investments, no commitments. Transfer money out or put more money in anytime to grow your money faster with us! Track how every single cent is doing with your portfolio dashboard in our mobile app, or just leave it as it is and watch it grow without lifting a finger.

It’s time for your money to work smart.

2. Don’t stop at personalise, humanise it.

We already know by now how important personalisation is to most customers. Globally, 67% of millennials prefer to buy brands that make an effort to tailor to their needs, and 73% expect to be able to customise products and services. These numbers go up to 78% in growing Asia markets.

But personalisation also has its limits. The form of delivering these personalised content are often transactional, like a “Here’s something for you” content section. At the end of the day, millennials still feel like they’re only as victims of up-selling and will not relate to the content on a human level.

Among banking consumers in Southeast Asia, 58% think their banks do not advise them correctly on their product needs.*

*Sourced from BCG Centre for Consumer Insights with 3,250 respondents across 5 Southeast Asia countries including Malaysia.

It will be worse when personalisation missed its mark, that will enforce deterrence against similar content in the future.

We must humanise our services by making them more nuanced and empathetic. Enabling genuine concerns for customers’ goals can make a greater impact in looking after customers’ financial well-being and earn their trust.

The ideas

Two key angles I want to highlight to help build a truly human brand for a bank towards the millennials – Empathetic offerings and humanised support.

Know how millennials are with their money. Understand their financial habits and difficulties, then play the supporting role of ‘being there for them’ and provide relevant offerings or support. Empathetic offerings cut in from knowing what their financial situations are and provide immediate remedies to build long term habits and relationship. Humanise our support system by allowing users more control of their own assets and access to reassuring knowledge.

Empathise with Millennials’ Financial Status through offerings.

Millennials are fast consumers, they feed on instant gratification and want to enjoy things before being able to fully afford them. And amongst the affluent millennials, they enjoy bite-sized luxuries in day-to-day life, and that is why purchasing large ticket items among millennials are more often than ever.

With that means more financial burden, and millennials are looking at financing options, especially when they cannot afford them. 41% millennials mentioned they are worried about their longer-term financial future, and 34% are worried about their day-to-day finances, especially during this pandemic. We can lend a helping hand in achieving their wants, and in return we get more commitments with their boosted purchasing power.

Flexible Payment Option

With Maybank, all your purchases can now be financed according to your needs.

With diverse and instant financing options, you can commit more and worry less. Pay in instalments with Maybank with no extra charges and enjoy more rewards in the meantime.

Track your instalments while they’re getting paid automatically every month from your wallet, or settle early anytime!

Credit Card Wallet

We as banks already know our customers’ credits well. If not, we have a huge pool of data to dive into – from savings account transactions to their e-wallet purchases. There’s no reason to not give them more credits if it means more seamless experience and trust-building. Besides, we can always tweak their credit limit as they go.

With Credit e-Wallet, gone are the days where you get annoyed with insufficient e-wallet balance and had to go through top-up in the middle of a payment transaction.

Enjoy frictionless payment with Credit e-Wallet where you can buy first and then pay later when you have the time. And with every punctual payment, you get higher and higher credit limit, so shop away!

Send calming waves to a sea of anxious minds.

Millennials get anxious easily. Being used to getting things resolved in an instant, they hold the same expectations for everything. So when there’s a delay in resolution, anxiety kicks in.

Especially during this pandemic, stress is evident. Around 1 in 5 millennials have been put out of work, and another 8% of them were working longer hours without compensation.

42% of millennials said they’re stressed all or most of the time, mainly about family, financial future and job prospects. If we, as a financial institution do our part in providing assurance through our offerings, we could see this as an opportunity to fortify their trust in us.

Recurring Payment Tracking

Remember the times where you forgot to cancel a recurring subscription or a trial that expired into a monthly fee?

No worries, we’ll help you keep track of them all in one view. Block unintended recurring payments with just a tap, or mark some other as trials so that we know when to tell you it’s ending.

Now you don’t have to keep track with your little notepad or credit card bills, we’ll do it for you.

Text me Mae-Be?

According to The Economist’s survey, 67% Southeast Asian millennials said that chat and messenger services are their primary use for their mobile phones.

Millennials are accustomed to reaching out or communicating via chat instead of phone calls, emails or other channels. To really be able to listen to millennials, we need to speak their language and use their preferred tool. An accessible Chat Support that is always ready to answer any queries would boost user confidence in trying out new features and eventually trust towards the brand.

And when chat agents are not available for help, a 24-hour cognitive chatbot with natural language processing, machine learning and AI-powered recommendations will lead to an uninterrupted expectation towards chat support, and a seamless experience that feels as natural as chatting with an actual friendly agent.

3. Banking with a purpose.

Most millennials now have access to all available information online, and they’re more educated than before. They are aware of worldwide social and environmental problems, and compared to their counterparts in other parts of the world, Asian millennials have a keener sense of social and environmental responsibility. In fact, their top concern is climate change (31%), compared to other concerns like unemployment (21%) and health (15%).

It’s extremely crucial for us to reflect in our initiatives if we want to resonate with them. Brands with purpose serve significantly better in long-term loyalty and relevance.

63% of millennials say they will choose financial brands with values that reflect social and environmental responsibility. In China, this number jumps to 78%. They mentioned that they are willing to pay a premium for brands that reflect these values.

*Survey is from Mastercard’s Global Needstates Segmentation study was completed by Kantar based on 20,909 millennials in 18 markets.

The ideas

Stand for a purpose, a brand that doesn’t stand for anything often stand alone. While banking services are undeniably essential for everyday lives, it’s important for us to act with clarity and purpose through our everyday offerings.

We know that they have desires to fill their lives with purpose, especially during these times. 76% millennials felt the pandemic has made them more sensitive and sympathetic toward real world issues and are interested to take action on it. 65% begun or increased efforts in recycling, even 20% chose to become vegetarians or vegans.

Round-up donations

Mind to spare some change? Now you can put your spare change towards a good cause.

Opt to round-up your purchases or spendings and donate them to a cause that you care about. Learn more about non-profit organisations handpicked by Maybank, and their effort towards making a change. Support with round-up change or recurring donations via Maybank.

Crowdfunding donations

Be part of Maybank’s social initiative to help underrated social campaigns by non-profits.

Get a glance of all ongoing initiatives by leading non-profit organisations near you and their progresses. Learn more about the campaigns and help fund them towards their goals with other like-minded people in the community.

Being part of and giving back to the community has never been easier with Maybank.

Conclusion

A lot of opportunities came to light to forge stronger connections, build trust and ultimately drive growth with millennials, by infusing humanity and personality into our brands and offerings. It’s time to see past traditional banking habits and adapt our services to fit in the new way of millennial living.

And in increasingly uncertain times like this, we as financial providers can offer empathetic guidance to help customers make sound decisions and progress in life with confidence. Integrate technology with empathy to create experiences that feel personal and as human as possible. With the right approach delivered precisely, a virtual experience can be just as authentic, personal and warm.

To communicate authentically, we must also find a way to reconnect with a core purpose – the original values that justify our existence beyond simply generating a financial return. Staying true to ourselves will help us understand our surrounding better, hence easier to remain relevant and adapt to new behaviours in the long run.

That’s my take on Millenial banking and thanks for reading!

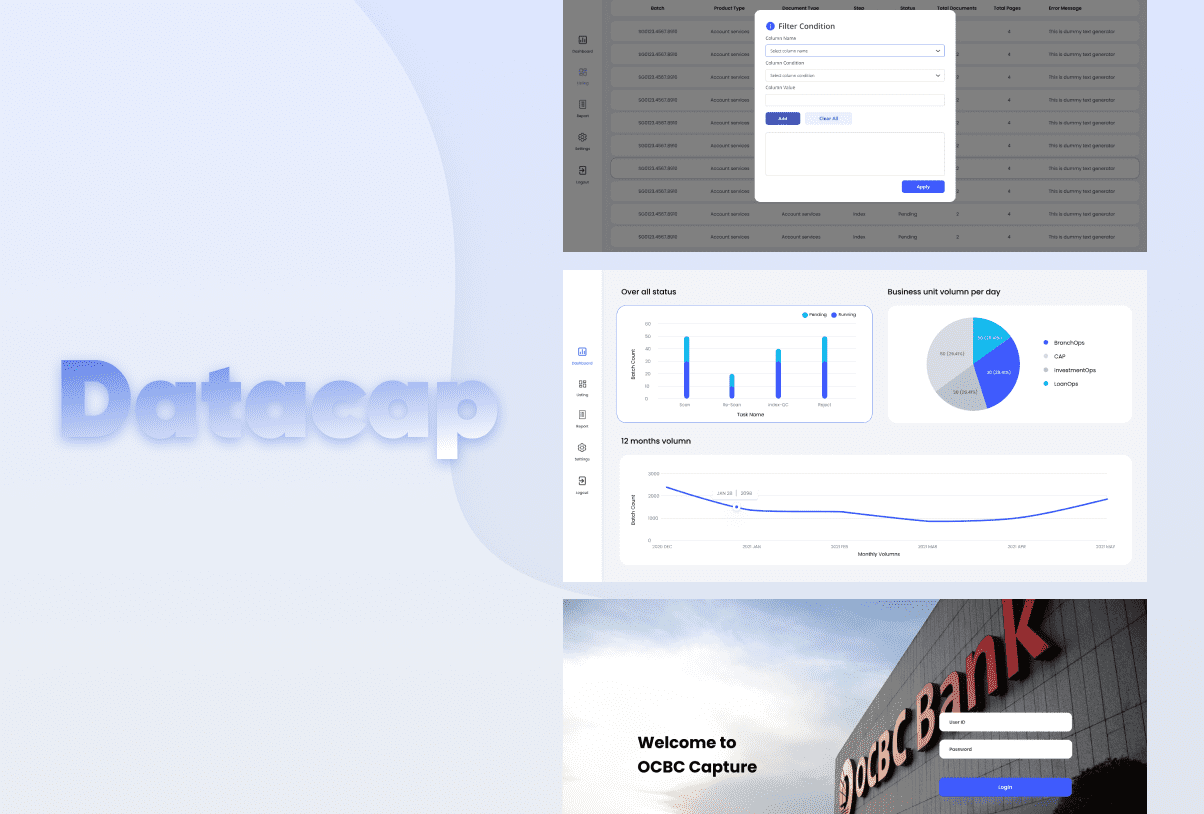

Datacap is a system for operation and account services staff to scan and key in with aim to capture and register customer forms and documents into the bank system. The bank’s top management see the need to reworked digital experiences to improve digital adoption bank wide, as well as elevate overall user experiences.

My role as the Lead UI UX Designer for this project encompassed conceptualising and implementing a user-friendly design, conducting usability testing and incorporating user feedback to enhance the user experience.

Purpose to revamp Datacap

- To improve the overall user interface design

- To improve user friendliness

- Reduce visual pressure

- Modernisation

- Organising sections and components

The problem

While the app is serving its purpose by having all crucial features up and running, and transactions are being made without hiccups and errors, the adoption rate and app stickiness remain stagnant. After talking to the business and reviewing their recent findings, we realize that most users only visit the app when they are incentivized with cash value rewards.

To assess the need for a redesign, I assessed all journeys of the major features like Wallet, Rewards, Ordering, Membership to identify deterrence caused by usability, benchmarking them against heuristics and best practices to quickly identify UI and interaction enhancements needed. Then, found opportunities to infuse a few quick wins to boost the app’s stickiness in the form of added value and convenience.

The solution

Putting users first and things where they belong.

The redesigned home page now has a stronger content hierarchy with fewer distractions in UI implementation. Neutral colors are applied to the majority of the components to eliminate competition from the brand color.

The information architecture was repurposed to put things where they belong, and repositioned them to have a more humane real-world context. While the business was not willing to reduce content to reduce clutter, I made the content more digestible without compromising business needs.

The problem

Redundant information and transactional experience.

The business was too focused on providing their clients with more value by giving them more information. They thought that providing more data points to the users would mean more value for the client to opt in for their app solution.

The solution

Eliminate redundancy and introduce human centricity.

The app was being positioned as more of a transactional app than a lifestyle app, deterring active users interacting with the complex level of information and data.

Simplifying the flow without compromising business requirements is a tough act to balance, but doing it right will let them complement each other, grounding the wallet feature with a better sense of navigation and goals.

My objective was to show what’s needed for users to be kept informed and eliminate redundancy throughout the content and user journey. Placing things where they make sense for users will significantly reduce the app’s cognitive load while maximising efficiency of each user feature.

The problem

Business-focused design and inefficient flow.

There are screens that were conspicuously designed around business requirements like the order screens. The form fields were populated only for the business to capture data they needed without the user’s behavior in mind.

Flow of the journey were rather technical than enjoyable, secondary information like food category were taking primary real estates, and visual cues were misleading, like fields and buttons appear greyed out when they are interactive.

Poor and inconsistent design library.

There were inconsistencies across pages in UI application as well as overusing of mismatched treatments like dark shadows and dark tints. Texts are bound in individual boxes, typography are overly varied, causing visual clutter to the eye.

The goal is to have uniform aesthetics across pages by minimising unnecessary variations, while increasing legibility and breathability of the design.

The solution

Intuitive and natural pathways.

Most users spend a lot of time on other food delivery platforms in their lives, hence it’s important to know that they also prefer your site to work the same way as the other platforms they’re familiar with.

Creating resonance in the order experience will create more natural pathways, while adding convenience along the way contributes to an intuitive journey.

Establish basic style guide.

Ensuring every variation created for each UI component to share the same nature and interaction will be necessary and scalable to multiple applications. Illustrations, header banners, listings, typography rules, icon type and placements, spacings, card padding rules, button rules are few of many good tools to reinforce consistency and achieve unity in UI aesthetics.